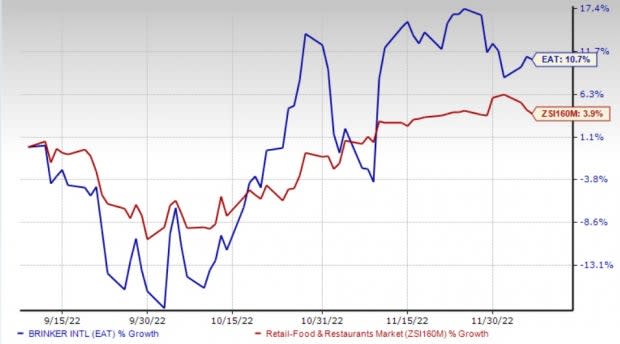

Brinker International, Inc. EAT is gaining from Chili's robust growth, expansion efforts and digitalization. Consequently, the company’s shares have gained 10.7% in the past three months, compared with the industry’s increase of 3.9%. However, high costs continue to have a negative impact on the company’s performance.

Growth Drivers

Brinker remains steadfast in its goal to drive traffic and revenues through a range of sales-building initiatives such as streamlining of menu and its innovation, strengthening its value proposition, better food presentation, advertising campaigns, kitchen system optimization and introduction of better service platform.

Chili’s turn-around strategies yielded positive results with traffic and sales moving in the upward direction. These strategies are focused on simplifying Chili’s core menu by improving recipes, strengthening value proposition with higher-quality ingredients and new cooking techniques to deliver better food at even more compelling price points.

During the fiscal first quarter, domestic comps at Chilli’s (including company-owned and franchised restaurants) rose 3.4% year over year. The upside can be attributed to an increase in dining room sales and traffic at the company’s franchise restaurants.

The company is also focusing on expansion efforts to drive growth. During fiscal 2022, the company opened 19 new restaurants, five of which are company-owned and the remaining 14 are operated by franchises. In fiscal 2023, the company expects to open 17 company-owned restaurants and 17-22 franchise-operated restaurant.

Image Source: Zacks Investment Research

Over the past few quarters, Brinker’s remodeling efforts have gained momentum. Notably, the company continues to invest in its reimage program. In fact, it continues to invest in a brand-wide reimage program that are likely to drive traffic and comps in the coming periods.

Meanwhile, the company has initiated innovation efforts to upgrade its kitchen. It started testing new equipment that delivers better products efficiently and boosts volumes. The company is positioned to invest aggressively to grow its business in fiscal 2023 and beyond. In the coming year, Brinker is expected to look for more ways to offer convenience, value, and a great guest experience by doubling its pipeline of new restaurant openings and expanding its portfolio of brands.

The Zacks Rank #3 (Hold) company also stands to gain from integrating its My Chili's Reward program with Plenti — a rewards program by American Express that offers leading brands across multiple categories. It gives Chili’s access to Plenti’s huge database of members and is likely to improve sales and profits.

Concerns

Rise in food and beverage costs and restaurant labor costs, including wage rates, training and overtime, continue to impact the company negatively. Higher repairs and maintenance expenses and increased utility expenses are added concerns.

Total operating costs and expenses in the fiscal first quarter were $975.3 million compared with $850.8 million reported in the year-ago quarter. The restaurant operating margin, as a percentage of company sales, was 6% compared with the 11% reported in the prior-year quarter.

Going forward, the company anticipates inflation to be in the mid-teens in fiscal 2023. For first-quarter fiscal 2023, the company anticipates food and beverage expenses to be more than $50 million. Also, it expects the restaurant operating margin to be between 4.5% and 5.5%.

Key Picks

Some better-ranked stocks in the Zacks Retail – Restaurants industry are Wingstop Inc. WING, Chuy's Holdings, Inc. CHUY and Chipotle Mexican Grill, Inc. CMG.

Wingstop sports a Zacks Rank #1 (Strong Buy) at present. WING has a long-term earnings growth rate of 11%. Shares of WING have declined 5.2% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Wingstop’s 2023 sales and EPS suggests growth of 18.1% and 16.4%, respectively, from the comparable year-ago period’s levels.

Chuy’s Holdings currently carries a Zacks Rank #2 (Buy). CHUY has a trailing four-quarter earnings surprise of 18.6%, on average. Shares of CHUY have increased 7.4% in the past year.

The Zacks Consensus Estimate for Chuy’s Holdings’ 2023 sales and EPS suggests growth of 8.6% and 11.7%, respectively, from the corresponding year-ago period’s levels.

Chipotle currently carries a Zacks Rank #2. CMG has a trailing four-quarter earnings surprise of 4.1%, on average. The stock has declined 9.8% in the past year.

The Zacks Consensus Estimate for Chipotle’s 2022 sales and EPS suggests growth of 15.1% and 31%, respectively, from the corresponding year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Brinker (EAT) Gains From Chili's Growth & Expansion Efforts - Yahoo Finance

Read More

No comments:

Post a Comment